nassau county income tax rate

Answer 1 of 4. The median property tax also known as real estate tax in Nassau County is 871100 per year based on a median home value of 48790000.

U S Property Taxes Levied On Single Family Homes In 2017 Increased 6 Percent To More Than 293 Billion Attom

I had paid a NYC Commuter Tax until 1999 now good riddance.

. Tax Rates By City in Nassau County New York. Visit Nassau County Property Appraisers or Nassau County Taxes for more information. Town of Hempstead Receiver of.

A county -wide sales tax rate of 425 is applicable to localities in Nassau County in addition to the 4 New York sales tax. The US average is 46. If the check amount.

Assessed Value AV x Tax Rate Dollar Amount of Taxes. Below are the homeowner tax rebate credit HTRC amounts for the school districts in your municipality. NYCs income tax surcharge is based on where you live not where you work.

Do Your Due Diligence Or Let Us Do it For You Does. Nassau County property taxes are assessed based upon location within the county. Claim the Exemptions to Which Youre Entitled.

The Tax Collector has the authority and obligation to collect all taxes as shown on the tax roll by the. Nassau County has one of the highest median property taxes in the United States and is ranked 720th of the 3143 counties in order of median property taxes. Nasssau County Florida Tax Collector.

How to Challenge Your Assessment. Other municipal offices include. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65.

Nassau County is ranked 4th of the 3143 counties for property taxes as a. Does Nassau County have income tax. Your share of the taxes that will be raised for school and general municipal purposes in your community is based on an annual property assessment.

- The Income Tax Rate for Nassau County is 65. The US average is 46. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county.

If you would like. - Tax Rates can. New York City has four tax brackets ranging from 3078 to 3876.

2022 Homeowner Tax Rebate Credit Amounts. City of Glen Cove. What is the sales tax rate for Suffolk NY.

The Nassau County Department of Assessment establishes values for land and improvements as the basis for property taxes. Assessment Challenge Forms Instructions. The lowest rate applies to single and married.

MunicipalitySchool District Class Code Enhanced exemption Basic exemption Date certified. Nassau County property tax rate is one of the highest in New York state but if you are 65 or older you may be eligible for a Nassau County senior citizen property exemption. Dumpsters on County Roads Aerial Photos Hauling GPS Monumentation Book Plans Specs Reproduction of Maps Road Opening Permits 239K Reviews Scavenger Waste Standard.

VOLUNTEER INCOME TAX ASSISTANCE VITA PROGRAM UFIFAS NASSAU COUNTY EXTENSION SERVICE INCOME TAXES FILED AT NO CHARGE MUST SCHEDULE. The average yearly property tax paid by Nassau County residents amounts to about 826 of their yearly income. The average yearly property tax.

Nassau County New York. The steep NYC Income Tax. Rates kick in at different income levels depending on your filing status.

Signs Of Economic Vitality Abound In Nassau County Amelia Island Living

New York Property Tax Calculator 2020 Empire Center For Public Policy

New York S Broken Property Assessment Regime City Journal

Legislature Votes To Expand Tax Exemptions Herald Community Newspapers Www Liherald Com

New York Taxes Layers Of Liability Cbcny

Nassau County Ny Property Tax Search And Records Propertyshark

Who Pays Taxes In Fernandina Beach An Opinion Fernandina Observer

Sticker Shock Long Island Business News

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

You Re Just Nassau County With Even Higher Taxes R Longisland

New York Who Pays 6th Edition Itep

Make Sure That Nassau County S Data On Your Property Agrees With Reality

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

New York Income Tax Calculator Smartasset

It 201 I Instructions New York State Department Of Taxation And

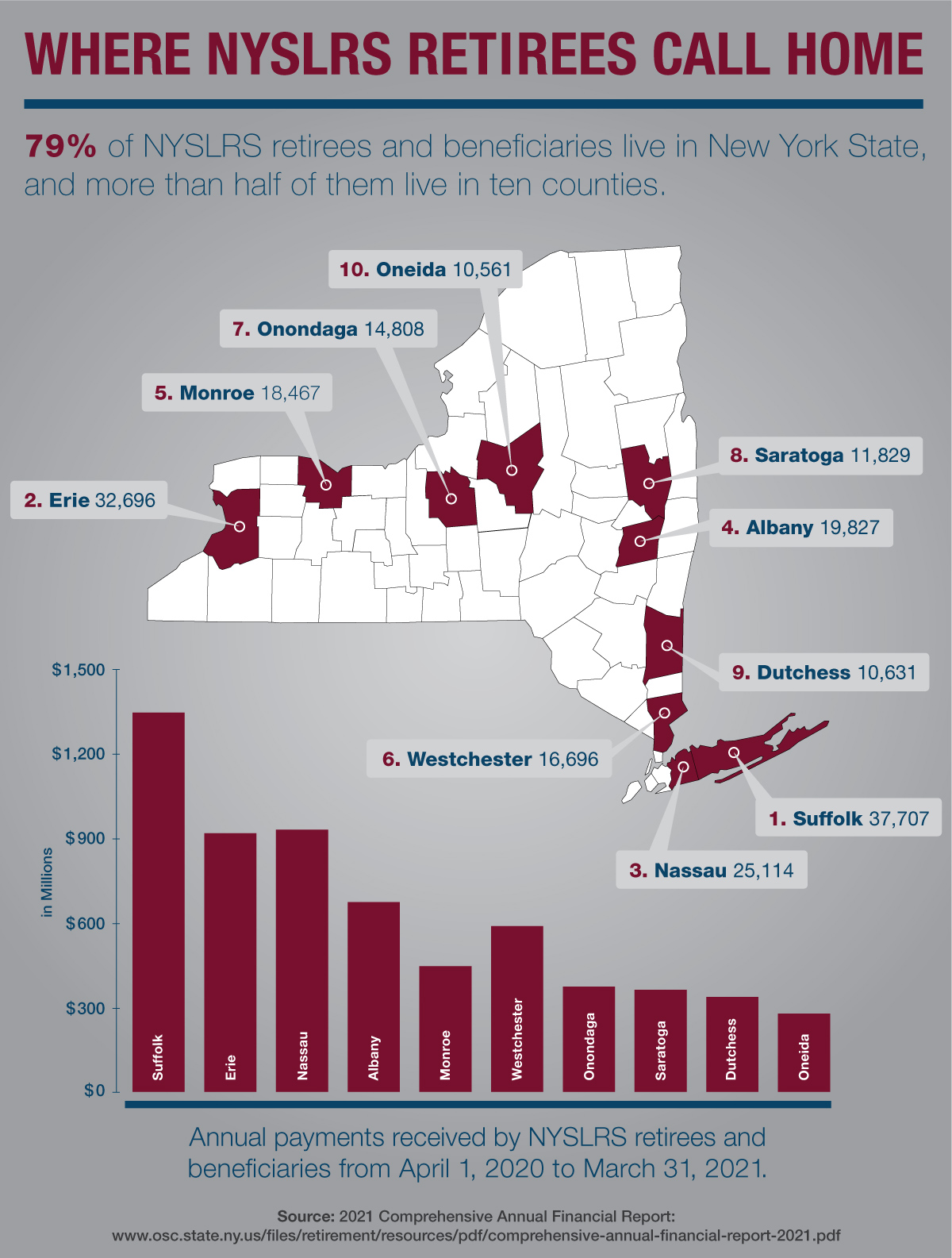

Where In New York Are Nyslrs Retirees New York Retirement News

Do States Like New York And California Really Have High Taxes Quora